It’s been a hot minute since I published Part 2. Achieving profitability out there has kept me busy. Better late than never: welcome back to the last part of my 3-piece series on achieving Profitability through Operational Excellence:

we will first go through The Profitability Canvas I developed,

then I will leave you with key-questions that help boost profitability

and my final thoughts on trends in the world of Tech M&A (you’ll get the connection when we get there).

Let’s recap:

To get right into it, I asked Gemini for its main conclusions from my previous article:

Adding to Gemini’s summary, maybe the most important take-away I want to emphasize:

with all the theory we’re delving into here, let’s not forget to be pragmatic!

Operational Excellence as a tool for Profitability.

The 3-Step Plan.

To recap, Part 1 provided a guide in the transformation towards a value-driven organization with profitable growth; Part 2 was all about the shift of mindset and setting objectives:

defining the overall goal - WHY, WHAT, and WHEN to reach profitability (Part 1),

setting functional objectives - aligning business goals on achieving profitability (Part 2).

Leaving the first two parts behind us, it’s finally time to let our creativity run wild and to use the functional expertise of our leaders (i.e. the HOW):

involving the teams in cross-disciplinary discussion to propagate initiatives that drive business profitability - improving unit economics (The Profitability Canvas; Part 3).

The Profitability Canvas.

Unless you're a knowledge sponge with wine in hand - multi-page theory dumps are hard to swallow. Even harder to extract action items for your own organization.

The best way to get a group focused and ready for action is by asking action-oriented questions - that’s what The Profitability Canvas is all about.

"The most serious mistakes are not being made as a result of wrong answers.

The truly dangerous thing is asking the wrong questions."

Peter Drucker

In the spirit of asking the right questions to cultivate great ideas, the Canvas provides a framework for and guides us through cross-disciplinary discussion.

It is split in two parts (revenue; cost).

To offer a starting point, the main levers for both increasing revenue and decreasing costs are already given (e.g. pricing & packaging or production cost). If you operate in tech - specifically B2B SaaS or a platform business - I believe the list to be fairly exhaustive. However, please be encouraged to add additional columns to the Canvas as you go.

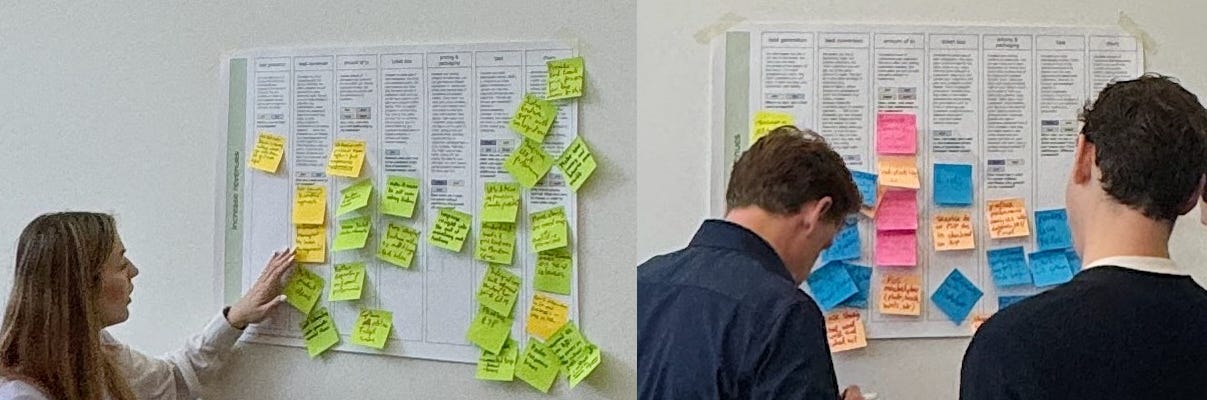

The questions in each column stimulate ideas and answers to be written down on everyone’s Post-its and stuck onto each column. The additional text helps set the context of each revenue or cost driver.

I suggest to hang copies of each part (revenue; cost) on opposite walls and let your functional leaders work through them clock-wise. Everyone should hold a stack of Post-its in the color of their department.

The color-coded department tags help identify the relevance of each question to each department.

Everyone is free to also put Post-its on questions lacking their department tag, however, it is best to start with your own team’s contribution first.

It is important to be concise and to the point: instead of writing down “serve customers better” as a solution to combat churn, think about the question a bit longer. Ideally, you know why your customers leave - the solution of a Head of Support might be to build a knowledge base, a Head of People & Culture or a COO might find the solution in changing the org structure and building a Customer Success team.

At this point it’s important to give your team the time to think but also to moderate them through the process if you feel the answers are too shallow. Continuously ask “why?” and “how?” to get the most actionable answers.

If you have no idea, try to think of a starting point like an analysis of churn reasons.

The Strategy Taskforce (STRA) is simply a placeholder for either leadership to contribute or for a multi-disciplinary team working on high-level organizational topics.

Once done, collect all Post-its and discuss the ideas with the group - making sure you understand every answer.

Together, group similar ones on one stack but don’t lose any of them: they might provide additional explanation or detail later on as we shape our initiatives and goals.

Time to marinate and add ideas as we go.

It’s often good to stop at Step 2 and let the exercise sink in.

It might also help to leave the Canvas up so people can add ideas later on. Even the most action-oriented questions sometimes don’t get everyone into game-mode immediatelly. We are all working on different timelines.

Re-visit the initiatives, discuss their impact on your business’s profitability, prioritize, and agree on up to 3 core initiatives per team

Eventually, however, we need to prioritize and agree on max 3 initiatives that we will work into our annual or quarterly goals.

They need to be formulated and tested against our company objectives (see Part 2) and have a clear quantification attached - enabling us to measure their success over the next weeks and months.

Slide 1 of the Canvas provides clear instructions on how to run the exercise, however, if you need any help or guidance, please reach out - I’m happy to help.

You can’t grow Flowers in Barren Soil

Having explored The Profitability Canvas and how it can catalyze cross-functional collaboration on profitability within your teams, let’s zoom out and see whether the ideas collected (proverbially the seeds) are falling on fertile ground - i.e. how they fit into the broader strategic picture.

While boosting operational efficiencies and driving profitability in every department individually is important, true success comes from aligning our efforts with long-term business goals (see Part 2) - especially considering the dynamic forces currently moving the markets.

Final Thoughts: Strategic Alignment for Sustainable Profitability

This is where many CEOs and CFOs face the biggest challenges: understanding how to balance immediate execution (often cost-cutting) with the long-term strategic alignment needed to build a resilient, profitable business.

We already touched on the Rule of 40 in Part 2, but let’s dive deeper into some of the key strategic levers that can help you balance growth with profitability.

“VCs have long started to adopt Private Equity M.O. to de-risk their portfolios"

Part 1

Part 1 focused on the somewhat recent shift in investor risk-appetite. Over the past 18 months we can, however, see another causally connected trend: due to less capital injection, market consolidation is accelerating. In 2022, SaaS Capital found 85% of all SaaS exits to have been acquisitions. As organizations are looking for new survival and growth strategies, Crunchbase expects this number will have significantly increased by the time 2024 comes to a close.

Putting those two trends together, companies need to not only optimize their operational efficiencies for survival but prepare themselves to be an attractive acquisition target at the same time.

Having worked through and negotiated on a number of M&A deals and exits at e.g. Lightspeed, PARK NOW, EasyPark, Formitable, and Zenchef - both on the buy as on the sell side and both in VC-funded and PE-funded ventures - I cannot stress enough how important it is to improve your OpEx and profitability ahead of any potential acquisition. Investors and acquirers look for companies with strong unit economics, sustainable growth, and operational excellence. The more we focus on improving these areas today, the better positioned we are for a successful exit (on our terms) tomorrow.

Side note: If you’re on the buy-side, you might want to consider a variety of tactics to capitalize on this trend and lower your target’s valuation. More on that in a future article.

Key Areas to Optimize

If you’re a CEO, CFO, CXO, you don’t have to run a full-on workshop to start optimizing!

Below I compiled key considerations you can use today to start fostering a healthy balance between growth and profitability.

GTM Optimization

Can we reduce our CAC by

refining our value prop, ICP, and our focus on the highest-conversion target audience,

optimizing CROs experimenting with our marketing mix,

or selling smaller, entry-level packages (land & expand)?

Customer Success and Retention

Can we grow LTV by

providing more (perceived) value to keep our customers engaged (retention/ reducing churn) - listen to Run the Numbers’ CJ Gustafson talk about monetization strategies and their need for consistently proving value to customers here,

building technical or service moats to enhance stickiness (retention/ reducing churn),

stimulating upsell and cross-sell into higher-value products to increase ARPA (land & expand)?

Do we have enough/ the right resources dedicated to drive long-term value?

Organization

Are we only paying for tech, talent, and assets we really need (“bad” vs ”good” costs)?

Do we have the right talent for the next challenges our organization will face?

Is our organizational structure set up to scale efficiently & effectively?

Do we have a clear idea on roles & responsibilities, who works on the WHAT & WHY, and who on the HOW?

Do we have performance management & growth paths for our staff?

Have we anticipated growing customer, investor, and staff expectations?

M&A Strategy

Selling: Are we putting enough resources in either building unique IP or a critical mass of customers?

Do we have the right metrics and storyline in place to support our claims?

Selling: Do we have a clear overview on our CapTable?

Do we both understand and agree under what conditions an exit makes sense for everyone’s agenda?

Buying: Do we know what assets we really need?

Have we done the honest math on whether and to what conditions this transaction makes sense?

Buying: Have we considered all types of transaction (e.g. Asset Transfer, Full Stock, Merger, Earn-Out, Partnership, …)?

More on this in another article.

Buying: Have we fully considered and included the costs of maintaining and integrating multiple platforms in our budget?

While building new products is consistently becoming easier, rule of thumb still suggests maintaining acquired products costs 3-4x the initial development.

I believe my experience at EasyPark can be considered a best-practice, whereas many dealing with Lightspeed’s product line-up will suggest they serve as a worst-practice.

Operational Efficiency

Are we continuously optimizing our operations for efficiency?

Are we automating and streamlining workflows to reduce resource needs?

Have we identified and addressed bottlenecks for growth (e.g. onboarding)?

How can we reduce our (variable) costs while scaling?

Are we leveraging our volume to obtain discounts and favorable terms with suppliers?

…

Capital Allocation and Financial Strategy

…

I have a more detailed version of the above available that provides additional context and deeper questions. Please shoot me an email if interested.

Conclusion: Get Outside Guidance & Council

The real challenge isn’t just identifying the right operational strategies - it’s ensuring those strategies align with your overarching business goals and the shifting dynamics of the market.

Doing so, you ensure your M&A activities don’t distract from your day-to-day.

Do you have the right exit plan and narrative?

This is where experienced advisory can make all the difference. As the trend toward consolidation continues, many companies find themselves either looking to expand through acquisitions or positioning themselves for exit. Having timing on your side gives you the strategic advantage when negotiating.

The most successful leaders I’ve seen are the ones who proactively build a strategy around improving OpEx and profitability before the market pressures make it too late.

If you need support boosting profitably or positioning your company for an exit, I’m happy to help you navigate these waters. With years of experience advising entrepreneurs and leading businesses through multiple successful exits, I bring a unique toolbelt with frameworks, strategies, and best practices.

Let’s connect and discuss how we can position your company for sustainable growth and profitability and set you up for achieving the next major milestone.

I hope this article has provided some food for thought. I’m curious to hear about your experiences around reaching profitability or with applying The Profitability Canvas in your process.

Interesting to hear your take on inorganic growth through the POV an operator. Refreshing. Keep the insights coming.