Achieving Profitability through Operational Excellence.

1/3: Why merely cutting costs is killing your business.

- This is the first part of a 3-piece series -

A paradigm shift in risk appetite.

The once prevalent „you’re not crazy enough“ (Masayoshi Son) attitude towards risk of top-line focused, 10%-success-rate-seeking, VCs encouraging us to grow and take on market share at any cost, has long made way to a more sensible approach of investors all across the board. As Chamath Palihapitiya - former AOL and early Facebook executive turned investor - already noted earlier this year: Venture Capital firms have long started to adopt Private Equity M.O. (modus operandi). With earlier funds having come to a grand reveal of ROI as per the end of their life-cycles, as well as due to continuously rising interest rates, funds of all sorts have started to de-risk their portfolios.

“What’s your P2P like?”

This shift comes with a new mandate for (founder) CEOs and their operations:

"We need you to become profitable. Fast!"

What has always been common for CEOs working with PE firms, has now become a reality for VC-backed ventures as well: we need to re-prioritize our strategic objectives and adjust our approach towards achieving the desired exit valuation. The script investors are looking for: a venture's Path to Profitability (P2P).

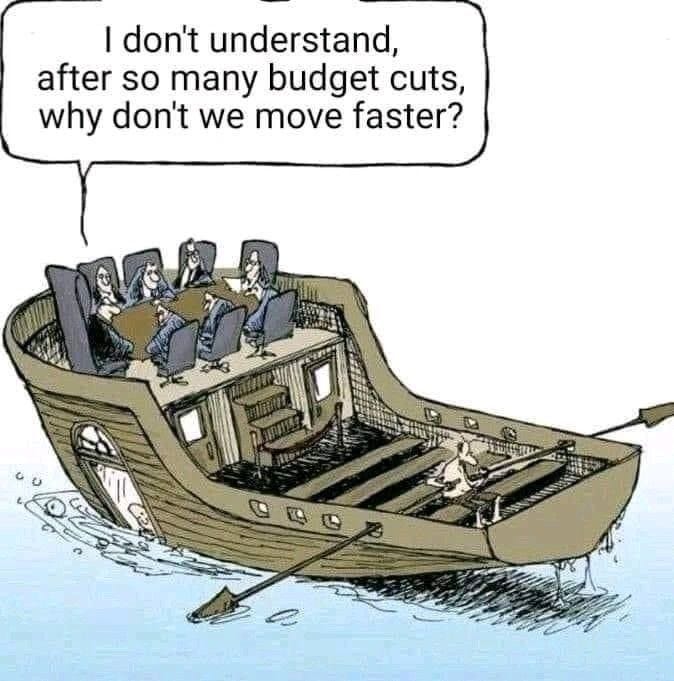

Why merely cutting costs is signing your company's death certificate.

Faced with this shift in priorities and operating under the Sword of Damocles called

"We're not giving you any more funding!"

(or only at ludicrously low valuations diluting your stake to next to nothing, debt-for-equity, or debt financing, that is), CEOs naturally look at cutting their costs to extend their runway. After all, Big Tech has led the way by laying off more than 180,000 workers in 2023 alone. With staff being - at least in Tech - commonly the biggest cost center, it seems obvious to start cutting here: taking the opportunity to let go of low-performers and divesting from failed (e.g. geo expansion) initiatives.

This is, however, where a CEO's strategy determines whether they just acquired a new lease on life or signed their company's death certificate!

Cutting costs with haste and without an integrated plan will have the business look profitable on paper in no time (assuming we continue to put severance under EBITDA). Focusing on low-hanging fruits like supposed low-performers or contracts running out might seem like a sensible approach, however, most Startups and Scale-ups don't have the infrastructure and tools in place to properly determine individual contributions. Without taking the time to gather information and make insight-driven, well-informed decisions, we simply exercise short-term cost cutting. And subsequently miss a huge opportunity for sustainable cost optimization.

While cost cutting is a short-term initiative solely dedicated to decreasing expenses ex post facto, cost optimization describes the proactive, continuous, business focused discipline aimed at maximizing value while reducing costs.

Short-term cost cutting kills sustainable cost optimization.

Giving in to reactive cost cutting (i.e. not differentiating between “good” and “bad” costs) without shifting to a value-driven, high-performance organization (i.e. sustainable cost optimization) will quickly result in unnecessary expenses bouncing back while sacrificing output at the same time: sales volumes will drop, churn is set to increase, and the business slowly slides into losses again. With one difference: this time with even less revenue and a shorter run-rate.

Good costs:

value-adding costs contributing directly to our value proposition. They are required to achieve our objectives. Think: expenses poured into Product Development, Marketing campaigns, or Customer Service - elements that drive the business forward.

▶︎ To be optimized.

Bad costs:

costs not directly contributing to business value. They are not aligned with our objectives and they destroy value or waste resources. Think: expenses poured into Marketing campaigns for legacy products, underutilized, expensive software subscriptions, or unused but paid employee leisure benefits.

▶︎ To be cut."Only 11% can sustain their prudent behaviors. The ultimate failure comes from taking their eyes off the future. Only 9% of companies create enough capacity to take on growth and innovation to support their long-term aspirations."

Harvard Business Review 02/23

Realizing the mistakes made and determined to bringing output performance back up, has proven to be a costly endeavor - more often than not replacing previously laid-off staff costing "as much as three or four times the position’s salary".

"Leaders who jump into cost cutting without first reaffirming the organization’s strategy are likely to send their companies into whiplash."

Harvard Business Review 02/23

Operational Excellence as a tool for Profitability.

CEOs - especially visionary founders - naturally look at their CFOs to tell them where to massage top-line projections (first resort) or where to cut costs (last resort). While most modern CFOs are able to spearhead annual strategic cost-optimization initiatives (e.g. through zero-based budgeting), they are most often not holistic enough (be it due to their profile or limited mandate) to single-handedly drive the sustainable transformation towards a truly value-based organization. It takes a seasoned business operator, who understands and works with all parts of the organization, to set priorities and focus - to turn every stone to make sure objectives are achieved with as little waste as possible (optimize input-to-output).

Therefore, the best way to trim your business for sustainable profitability is through anchoring your goal in clear objectives and putting focus on operational excellence.

The 3-Step Plan.

The below plan helps guide us in this transformation towards a value-driven organization with profitable growth. It is split in three parts:

defining the overall goal,

setting functional objectives,

and involving the teams in cross-disciplinary discussion to propagate initiatives that drive business profitability (The Profitability Canvas).

“If the only tool you have is a hammer, you tend to see every problem as a nail.”

As Maslow already famously put it: we humans are subject to the cognitive bias that is trying to solve problems by immediately jumping to the solution. When setting the right objectives for reaching profitability, we therefore need to take a step back and first understand what profitability even means in our specific context.

Figure out WHY, WHAT, and WHEN to reach profitability:

WHY are we trying to reach profitability? Are we forced by shareholders? Do we plan an exit contingent on profitability?

Keep in mind: the pursuit of profitability will likely - at least in the short term - slow down top-line growth. Did we misread our investor's call for improved unit economics as one for short-term profitability? Are we tested whether we can make hard decisions? We need to figure out the real WHY to shape our plan.WHAT does profitability mean in our context? Do we truly have to turn a profit on the bottom line or is it sufficient to prove our core operations could be profitable if we spent less on top-line growth (e.g. Marketing) or experimental innovation (e.g. expanding our product portfolio). What are the unit economics our shareholders want to see?

Remember: In times where everyone else slows down to follow more sustainable growth, opportunities open up for the ones with longer financial stamina to absorb competitors, integrate vertically, or to poach clients.WHEN do we need to reach our goal?

The imminence of the challenge determines our plan and execution. Do we plan for 2024 or do we have until 2026? For example, the timing dictates whether we divest from an under-performing region immediately or, instead, re-analyze the markets. We might gather more data with additional performance metrics or bundle multiple regions together to optimize our cost structure: de-risk yet keep our local foothold.

If we want to achieve profitability throughout the business, we need to engage every member of our team to think along.

Next up…

I will leave you with the above for Part 1 of this series.

In the next article (Part 2) we dive deeper into the full 3-Step Plan: including some practical examples and rudimentary metrics to set targeted functional objectives.

Until then, I recommend reading the story about how Hubert Joly turned around BestBuy after coming onboard as new CEO in 2012.

Spoiler: it was not achieved through cutting personnel.

Part 3, the last part of this series, will contain my Profitability Canvas. It helps guide the team exercise of understanding profitability and coming up with department-specific initiatives to reach it.

I hope this article has provided some food for thought. Thank you already for your input, interest, and great discussions! I’m curious to hear about your experiences around reaching profitability or with applying the above exercise in your process. Please feel free to share your experiences and thoughts.

Nice perspective. Very well written. Looking forward to the next part.

Great piece! Well done